土耳其地震金价走势分析图-土耳其地震金价走势分析

1.美国现十年来最大破产潮了?

2.英文翻译高人-快来,帮小弟翻译点东西(悬赏50)

3.地震金价到底会涨还是会跌。为什么会涨跌?

美国现十年来最大破产潮了?

是的。8月15日据外媒报道,今年以来美国已经有400多家大型企业宣布破产,这是十年来最糟糕的数据。主要原因是受到疫情的影响,各行各业遭受数以十亿美元计的损失。分析人士认为,这是一场看不到缓和迹象的经济地震。

据埃菲社纽约8月13日报道,美国标准普尔全球市场情报公司在一份报告中指出:“在新冠肺炎疫情的背景下,2020年大量部门受到了破产的影响。但以消费者为中心的行业遭受的损害尤为严重。”这份报告包括了资产或债务超过200万美元(1美元约合人民币6.94元——本网注)的上市公司和超过1000万美元的私营企业。

报道称,据该公司分析师塔耶芭·伊鲁姆和克里斯·赫金斯统计,截至本周早些时候,累计已有424家大型企业破产,“超过了2010年以来这一可比时期的处理数量”,原因是经济急剧萎缩。

扩展资料

非必需消费品行业受影响最大

受影响最严重的是非必需消费品行业。共有超过100家大型企业破产,其中包括20家历史悠久的零售商,如美国老牌服装企业布克兄弟,拥有最古老大型百货商场的洛德-泰勒百货公司,以及克鲁服装集团和安·泰勒等流行品牌。

最具视觉效果的破产零售商可能要数尼曼·马库斯公司的高端门店。一年多以前,该公司一家面积两万平方米的门店开业,位于纽约哈德逊城市广场专属商业区中心。但在疫情造成停工之后,公司决定将其闲置。

这一浪潮的其他“受害者”属于餐饮业,如经营必胜客和温迪快餐的特许经营商NPC国际公司。该公司受到门店关闭和游客缺乏的影响。

新华社客户端—美国现十年来最大破产潮 外媒:一场看不到缓和迹象的经济地震

英文翻译高人-快来,帮小弟翻译点东西(悬赏50)

1, 3-mining analysis of the value of

1, cost analysis

The three-rich mining site visits, the company has completely the mining company's main cost of production outsourced to Wenzhou Jian-feng Mine Engineering Company Limited, on the other three belong to the rich mining operations rather than face-underground mining operations, therefore, mining units The basic cost of the original ore locked.

The beneficiation process does not need a large, sophisticated equipment, primarily for ore processing mill and simple facilities, with the company's technology and staff to understand the equipment before and after the Spring Festival each year only to conduct a comprehensive overhaul, and routine maintenance costs low. After investigation, 06 and 07 respectively, the maintenance cost is 06,000 yuan and 10,700 yuan (updated some accessories), and the maintenance costs of both the company's management costs, therefore, the costs could be roughly in accordance with the annual management Together with the proportion of costs together.

However, as 07 three-ore mining a large number of outsourcing, and outsourcing of the ore grade is far lower than the three-produced by mining ore grade and therefore, according to 07 estimates the cost is relatively high, and under 06 data The cost estimates were relatively in line with its own three-mining the actual situation.

06 According to financial data and mining of calculations:

Main business costs = 2484/11 = 225.8 yuan / ton

Cost of sales = 452,000 yuan / 110,000 tons = 4.1 yuan / ton

Management fees = (338-100) / 11 = 21.64 yuan / ton (including management fees of 1 million yuan tax resources)

2, sales analysis

As the three-ore mining unit of the production costs can be regarded as the basic lock, the only way to have an impact on the operational effectiveness of the metal is the market price changes. The mine ore in the original principal containing zinc, lead and silver, and ore of lead and zinc grade of about 1:4, said the company's future profitability mainly depends on the zinc price fluctuations. Below will combine historical data on zinc, lead and silver price trends do an analysis:

1) lead, zinc prices overall trend analysis

According to Non-ferrous Metals Industry Association statistics, China's lead-zinc mine in the mountains, close to depletion of resources accounted for 56.6 percent, a crisis of 23.9 percent, the resources are protected only 19.5 percent, the existing lead, zinc reserves are dynamic exploitation of life assurance Less than 10 years. And the global lead and zinc reserves situation is not optimistic, dynamic exploitation of protection less than 20 years. 2009, the shortage of lead and zinc resources of the state of the market will be more and more attention, lead and zinc prices will be even more outstanding performance.

2) Lead

Lead from the past five years and the price of nearly one-year price trend analysis, with the current situation of scarce resources gradually, the current prices can be seen as a low the next few years, that is 13,200 yuan / ton, the high point of 29,600 yuan / Tons, the average price of 21,600 yuan / ton.

3) zinc

Zinc from the past five years and the price of nearly one-year price trend analysis, with the current situation of scarce resources gradually, the current prices can be seen as a low the next few years, that is 13,200 yuan / ton, the maximum 35,800 yuan / ton, The average price of 200 million yuan / ton.

4) Silver

Silver prices linked with the yellow metal prices, the impact on the international market price factors more. With the U.S. economy slowed, the Fed lowered interest rates a row, the future trend of market confidence in the dollar remains weak, negative remarks gold prices fell slightly. However, due to the recent geopolitical tensions and dollar weakness is still an effective support to gold.

And open to the snowstorm, the weather and the impact of the recent earthquake non-ferrous metal prices have driven up the domestic spot price of silver all the way up, recently, China's stock market fell below the continuous line, the market investment hot spots of the precious metal market. Silver prices in the international and domestic double favorable environment steadily increased, the price of silver is expected in the next few years will remain at Wenzhongyousheng situation.

Therefore, the silver set may be rough for the low price of 2.5 yuan / g, high point of 4.75 yuan / g, an average price of 3.5 yuan / gram.

中文 ? 英语 翻译

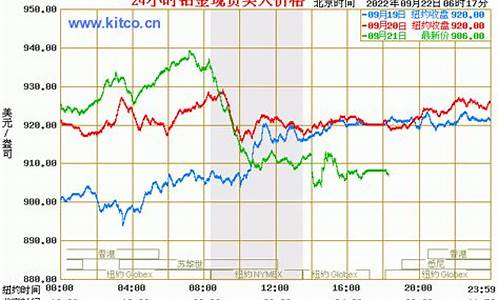

地震金价到底会涨还是会跌。为什么会涨跌?

我的天,500字以上?地震金价是否会涨跌,这个是靠黄金的属性决定的!黄金除了具有贵金属属性以外,还具有货币属性等多种属性举例而言,日本地震发生后,给本国造成巨大损失,会导致本国经济衰退,本国内很多资金纷纷撤退,卖出资产,而黄金作为一种避险品种(至于为什么能避险,源于黄金在任何时候都不会贬值,永远有价值,而且黄金本身还具有世界货币属性,本身就有很高价值,这是和目前纸币最大不同),自然相比而下,没有比把钱放在黄金里面更安全的了,所以,黄金受到其他国家资金和从日本国内撤出资金的追捧。这种上涨源于投资者规避风险的一种希求。第二,从美元分析,当日本遭受大地震后,日本一定会大量出售本国资产,并且命令各投资者抛空美元,买入日元回家搞建设,所以,美元再度被打压下跌,而国际黄金价格是以美元为标的的,美元下跌,黄金当然会涨,这个里面还有从美元里面撤出来的资金(因为美元也是一种避险货币),两个因素合起来,黄金当然会涨了!理解思路:从黄金的避险需求和美元的走势来分析。这样你就不会对黄金的涨跌疑惑了!

[免责声明]本文来源于网络,不代表本站立场,如转载内容涉及版权等问题,请联系邮箱:83115484@qq.com,我们会予以删除相关文章,保证您的权利。